End-of-Year Market Update: Navigating the Shift to a Buyer's Market

In this blog, we'll be breaking down the November stats provided by the Toronto Regional Real Estate Board (TRREB). They are specifically for the City of Toronto which includes Etobicoke, Central Toronto, North York, East York and Scarborough.

In our final market report for 2023, the latest stats, unsurprisingly, continue to outline a market favouring buyers, with increased listings, slower sales, and longer days on market. This encapsulates the ongoing shift we've observed throughout the year.

With mortgage rates holding steady, the next few months could see more stability in buyer and seller behaviour. The unchanged rates might encourage those on the fence to take action, especially if rates are predicted to lower in the near future.

However, as we enter the holiday season, traditionally, real estate activity tends to slow down. People often focus on family and holiday preparations, which temporarily reduces market activity. Expect a possible uptick in early spring, as buyers and sellers return with renewed interest post-holidays.

“Inflation and elevated borrowing costs have taken their toll on affordability. This has been no more apparent than in the interest rate-sensitive housing market. However, it does appear relief is on the horizon. Bond yields, which underpin fixed rate mortgages have been trending lower and an increasing number of forecasters are anticipating Bank of Canada rate cuts in the first half of 2024. Lower rates will help alleviate affordability issues for existing homeowners and those looking to enter the market," said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

While the Toronto market is experiencing lower sales activity, sellers show readiness to engage with new listing numbers that align with historical November trends.

This indicates a growing buyer's market where buyers have a stronger hand, shaping a market dynamic that requires sellers to be particularly strategic in their approach.

The 26.2% dip in new listings from October to November is typical, reinforcing the market's seasonal pattern.

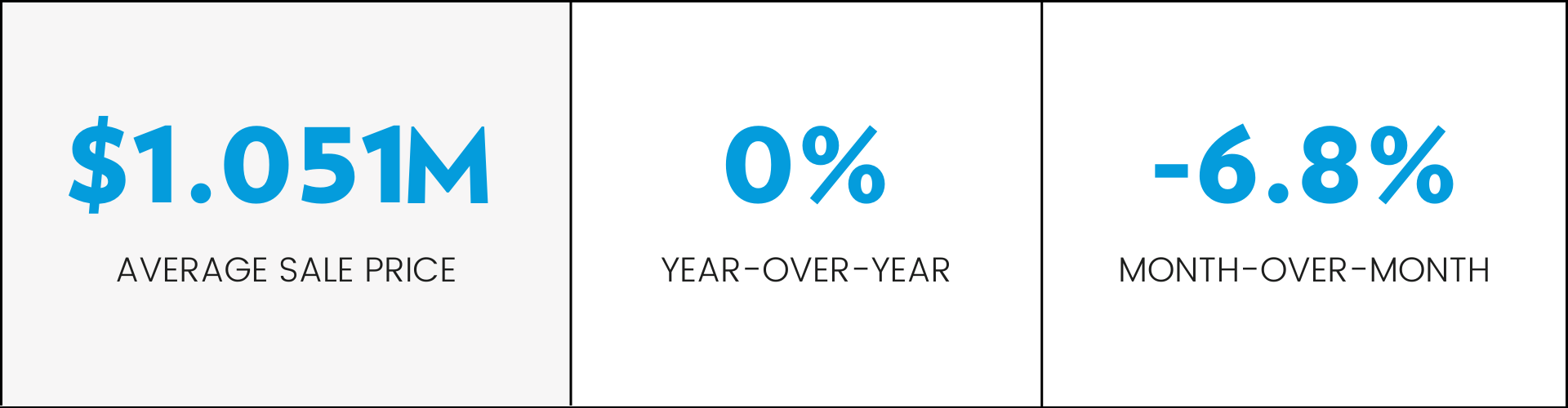

In the context of the November market dynamics, where new listings are aligned with historical trends yet sales activity is lower, the average price's stability and minor fluctuations throughout the year fit into this broader pattern.

This pattern reflects a blend of typical end-of-year slowdowns and the market's reaction to wider economic factors like interest rate shifts and supply-demand dynamics.

The slight dip in the average price from last month and the gentle year-long price fluctuations are a testament to the market's resilience and adaptability as it navigates through these varied influences.

Understanding key real estate market metrics: sales to new listing ratio, days on market, and months of inventory

The sales to new listing ratio tells us how many of the newly listed properties are being sold in a certain time frame. If the ratio is around 50%, it means the market is balanced. But if it goes above 60%, that's when we start to see a seller's market, where prices tend to rise. So, the higher the ratio, the better it is for sellers and the more competitive the market becomes for buyers.

The average days on market refers to the average amount of time that it takes for a property to be sold after it is listed for sale. This can be a useful metric for understanding how quickly homes are being snapped up in a particular area.

Lastly, the months of inventory ratio is a measure of the amount of time it would take for all of the currently listed properties to be sold, based on the current rate of sales. It's a useful metric for understanding how much supply there is relative to demand in a particular area. For example, if there are 100 properties currently listed for sale and 20 of them are sold each month, it would take 5 months to sell all of the properties (100 / 20 = 5).

November 2023:

November 2022:

As we conclude the year, the Toronto real estate market's gradual shift towards a buyer's market becomes more pronounced.

Buyers now find themselves with increased leverage and choice, a stark contrast to the past frenzy.

For sellers, this shift demands a strategic approach, emphasizing the importance of pricing and presentation.

With forecasters predicting Bank of Canada rate cuts in early 2024, this scenario presents a potential stimulant for buyer interest. For sellers, this could mean a return to more competitive conditions.

However, these predictions are subject to economic shifts, so both buyers and sellers should stay informed and flexible in their strategies as the market evolves.

As we close out 2023, I extend a heartfelt thank you for following along. We'll be back in 2024, ready to dive into the next chapter of Toronto's real estate market.

If you have any questions or would like more information on recent home sales in your specific neighbourhood, don't hesitate to connect with us here.